Meta Surges in Q3 as Zuckerberg Doubles Down on AI Future

Adshine.pro10/30/20257 views

Adshine.pro10/30/20257 viewsMeta has released its latest quarterly report, showcasing another period of steady growth in both revenue and user numbers, as the company continues to pour vast resources into its long-term bets on artificial intelligence and virtual reality.

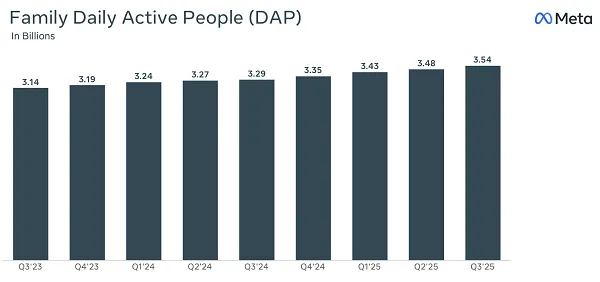

Starting with user growth — Meta added an additional 60 million users across its family of apps in Q3, bringing its total to 3.54 billion monthly active users.

That’s a remarkable achievement for a company whose flagship platforms, Facebook and Instagram, are already at or near saturation in many major markets. The gains are largely coming from developing regions and from Threads, which continues to contribute to Meta’s expanding user ecosystem.

While Meta doesn’t break out platform-specific figures, this aggregate metric across Facebook, Instagram, Messenger, WhatsApp, and Threads indicates that the company’s global footprint is still expanding, even at its massive scale.

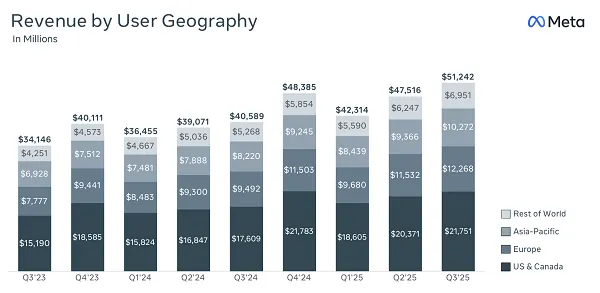

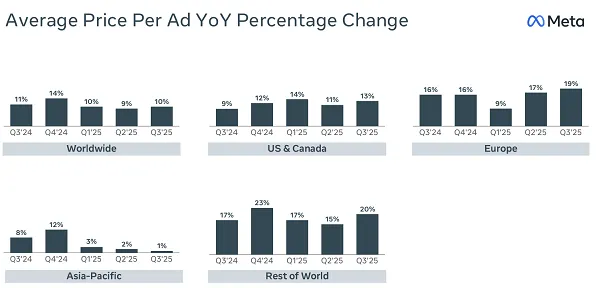

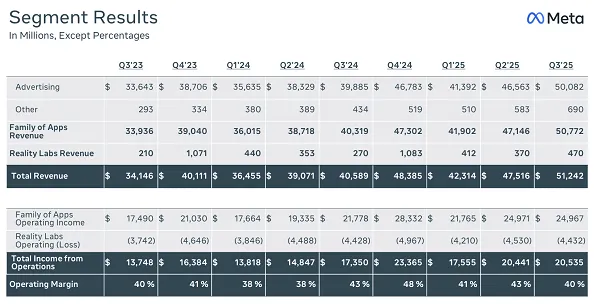

On the financial side, Meta reported $51.24 billion in revenue for the quarter, up 26% year-over-year — a strong showing that underscores its dominance in digital advertising.

Despite its diversification efforts, advertising still makes up 97% of Meta’s income, with the majority coming from U.S. audiences. However, new revenue streams such as Meta Verified subscriptions and the growing demand for its AI-powered smart glasses are beginning to make a small but notable impact.

Meta’s latest “Display” model of its smart glasses includes a heads-up display and a wrist controller, while the company has also confirmed plans to distribute fully AR-enabled glasses to developers in 2026, with a consumer launch targeted for 2027.

Zuckerberg envisions a future where AI-driven eyewear replaces smartphones as the primary connection device, and if that vision materializes, it could dramatically reshape Meta’s business model.

For now, however, these ambitions are coming at a heavy cost. Reality Labs, Meta’s division responsible for VR and AR, recorded a $4.4 billion loss in Q3 — continuing a long streak of deep operating losses that have offset stronger results from its ad business.

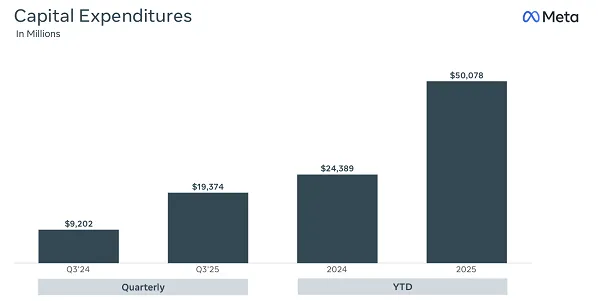

Meanwhile, Meta’s AI investment continues to soar to staggering levels. Zuckerberg projected earlier this year that the company would spend roughly $65 billion on AI infrastructure in 2025, primarily to build massive new data centers. But according to Meta’s latest update, that number may rise even higher.

As the company stated:

“As we have begun to plan for next year, it has become clear that our compute needs have continued to expand meaningfully, including versus our expectations last quarter... our current expectation is that capital expenditures dollar growth will be notably larger in 2026 than 2025.”

Just this month, Meta broke ground on a $1.5 billion data facility in El Paso, Texas, its 29th such development in the U.S. The scale of this investment underscores how central AI has become to Meta’s future — but it also highlights the sheer cost of competing at this level.

Such immense spending will likely edge out smaller players — and possibly even mid-tier competitors — from the AI race altogether. Analysts have already raised concerns about the sustainability of funding at companies like OpenAI and xAI, while deep-pocketed giants like Meta, Google, and Apple appear far better positioned to endure the long, expensive road ahead.

Still, these bets must eventually pay off. For all the excitement around generative AI, the technology has yet to deliver the revolutionary change its backers promise. To justify trillions in cumulative investment, the industry will need to show tangible, transformative results — something Meta is clearly banking on.

Alongside its financial updates, Meta also cautioned investors about potential regulatory risks in both the U.S. and the European Union.

“In the EU, we continue to engage constructively with the European Commission on our Less Personalized Ads offering. However, we cannot rule out the Commission imposing further changes to that offering that could have a significant negative impact on our European revenue, as early as this quarter,” the company said.

“In the U.S., a number of youth-related trials are scheduled for 2026, and may ultimately result in a material loss.”

As lawmakers around the world push for tighter controls on social media — particularly for minors — Meta faces growing regulatory uncertainty that could weigh on its future earnings.

Still, despite those challenges, Meta’s core business remains robust. Its ad business is performing exceptionally well, user growth continues globally, and its technological ambitions — while costly — could secure its dominance for years to come.

Yes, there’s considerable risk in betting so heavily on AI and VR, both of which remain unproven at mass scale. But Meta is playing the long game, positioning itself to define the next phase of digital connection.

For now, at least, Zuckerberg’s empire remains one of the most formidable forces in the modern tech landscape — and one of the few companies with the capital, ambition, and conviction to try reshaping the future itself.

📢 If you're interested in Facebook Ads Account, don't hesitate to connect with us!

🔹 https://linktr.ee/Adshinepro

💬 We're always ready to assist you!