Meta Discloses Key User Engagement Metrics Amid FTC Antitrust Battle

Adshine.pro05/23/202568 views

Adshine.pro05/23/202568 viewsMeta's ongoing legal showdown with the FTC—which could ultimately force the company to divest from Instagram and WhatsApp over antitrust concerns—has led to the release of several revealing insights. These disclosures are part of Meta’s broader push to demonstrate that it doesn’t hold a monopoly in the digital advertising space and that it faces strong competition from other major players.

While much of the evidence being presented is anecdotal or lacks broader industry implications, some of the data shared during the trial provides valuable takeaways for advertisers. These insights offer a clearer picture of current social media trends and can help shape more informed advertising strategies.

One key point that’s been made undeniably clear: video is now the primary focus on Facebook.

Here’s an overview of some of the graphs and stats that have been presented in the case.

First off, if you were still unclear, video is the focus on Facebook:

As you can see, more and more people are spending more and more time watching video on Facebook.

And Reels specifically have been the big winner over time:

As illustrated, overall engagement with Facebook’s News Feed has declined, and Facebook Stories have yet to gain significant traction. However, Reels continue to gain momentum, largely due to Meta’s aggressive push to place more of them in front of users.

This trend shouldn’t come as a surprise. Meta has attributed its growth in user engagement on both Facebook and Instagram to the transition toward an algorithm-driven feed centered on recommended Reels. If you use either platform regularly, you’ve likely noticed the near-constant flow of short-form videos.

From a trend-watching standpoint, this shift is important—it shows how users are now engaging with Facebook and Instagram differently than in years past.

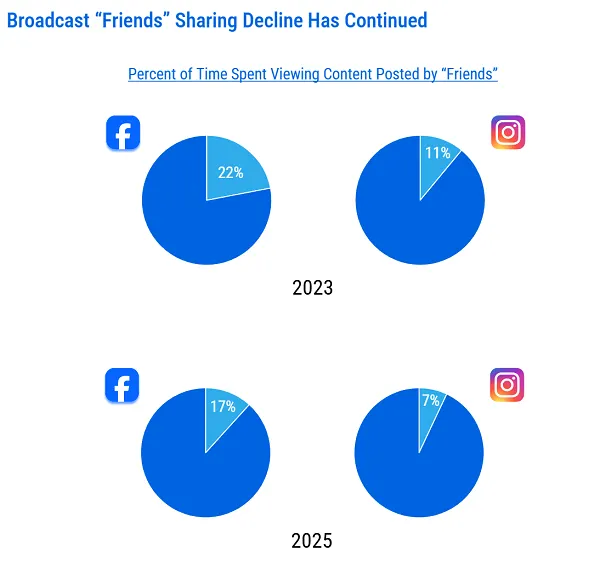

During opening statements in its legal defense, Meta also revealed that users send 63 times more private messages across its platforms daily than they make public posts. This underscores the broader behavioral shift: video is now the go-to for entertainment, while messaging dominates social interaction.

Public posting? It's no longer a central part of how people use Facebook or Instagram.

So, what are the implications for marketers?

If users are primarily using these platforms for entertainment, ads can still be effective—just as they were when people were more focused on sharing updates with friends. However, it’s important to understand that true engagement is increasingly happening in direct messages (DMs). This shift suggests that DMs could be a more powerful channel for fostering transactional and relational connections with your audience.

That’s a big part of why Meta’s Click-to-Message ads are seeing a surge in popularity.

It also explains Meta’s growing emphasis on creators. Since everyday users are posting less, keeping the content feed active now depends more on creators. To retain user attention, platforms must support and reward creators for producing the engaging content that drives platform stickiness.

As for content type? It’s all about video. If your brand isn’t leveraging video yet, now’s the time to start. The data and user behavior trends are clear—video content is dominating attention.

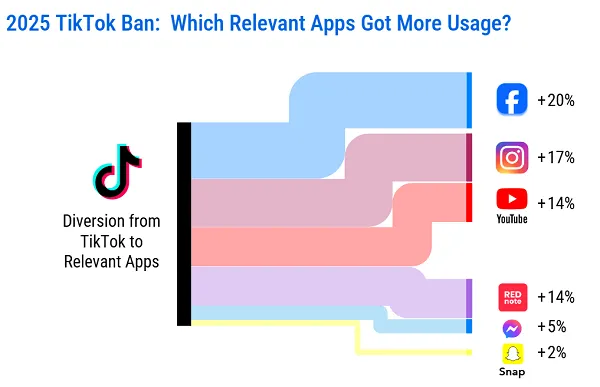

Meta also presented data showing which platforms saw increased usage during the brief TikTok ban in the U.S., offering further insights into user migration patterns and platform preferences.

So if TikTok is eventually kicked out of America, due to the “Protecting Americans from Foreign Adversary Controlled Applications Act,” you can likely expect Facebook, Instagram, and YouTube to scoop up most of that traffic.

Meta’s also noted the increasing similarity between apps, with every platform copycatting each other.

No big surprises here—but it is worth noting how increasingly similar these platforms have become, as they continue borrowing features from each other. The result? Less differentiation, more overlap.

These are just a few of the insights to emerge from the ongoing Meta vs. FTC trial, offering a rare look into the actual internal data from Meta’s headquarters.

If you’re aiming to better understand the evolving landscape of social media trends, this gives you a solid snapshot.

📢 If you're interested in Facebook-related solutions, don't hesitate to connect with us!

🔹 https://linktr.ee/Adshinepro

💬 We're always ready to assist you!